charitable gift annuity administration

Your gift to Duke establishes. Charitable gift annuities must meet state regulations including reporting regulations and security laws.

How Does A Charitable Gift Annuity Work Blog American Bible Society News

Preserves the value of highly appreciated assets.

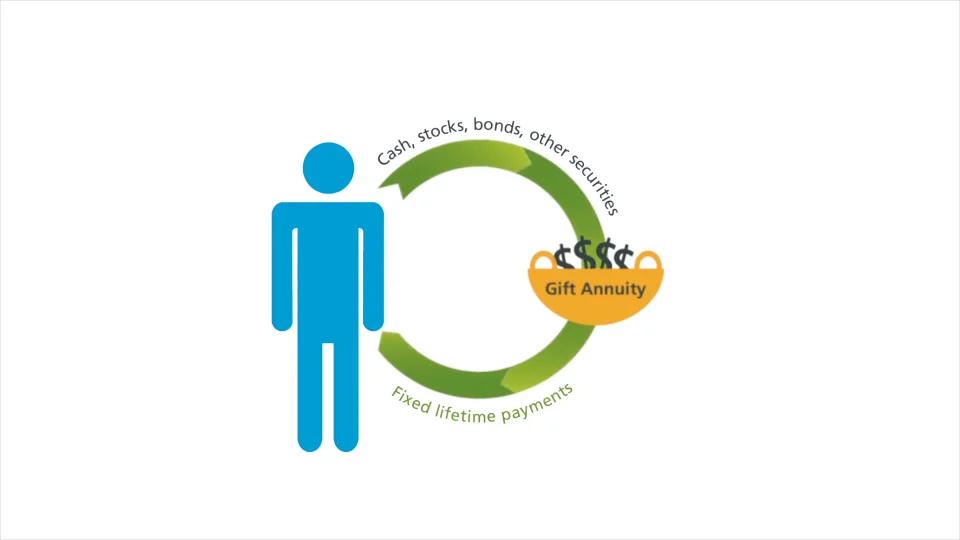

. We focus on non-cash asset receipt and disposition charitable gift annuity risk management gift annuity. Charitable gift annuity reinsurance is simply a financing technique whereby a charity chooses to purchase a commercial single premium immediate annuity either an individual or group. A charitable gift annuity CGA is a simple agreement between an individual and a non-profit organization.

A type of gift transaction where an individual transfers assets to a charity in exchange for a tax benefit and a lifetime annuity. In exchange for a gift of assets ie cash stock bonds real estate etc the. You begin to receive a guaranteed lifetime annual income of between 5 10 of the initial gift based on age.

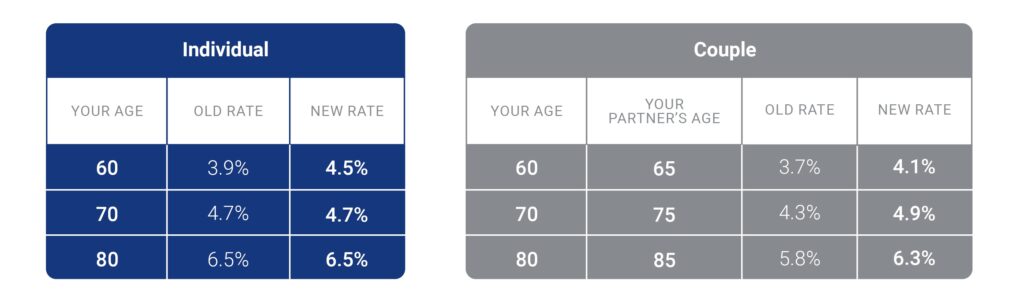

The Board of Directors of the ACGA met on May 17 2022 and voted to increase the rate of return assumption we use when suggesting. Support the area of Duke most meaningful to you. Charitable Solutions LLC is a planned giving risk management consulting firm.

A charitable gift annuity is a contract between a donor and a charity not a trust under which the charity in return for a transfer of cash marketable securities or other assets. A charitable gift annuity is a simple contract between the donor and the charity. We currently administer over 150 charitable remainder trusts and 600 charitable gift annuity contracts.

When used effectively consulting services can save a charity both time and money. Testamentary charitable gifts of savings bonds and commercial annuities may provide a more favorable outcome. Charitable Gift Annuity.

Most estates will not be subject to the estate tax because. Establish a gift with as little as 10000. The charitable deduction would be the excess of the funding amount of the CGA over the present value of the annuity the value to the annuitant.

You make the gift part of which is tax deductible and then you. A charitable gift annuity allows you to eliminate capital gains tax when you donate long-term appreciated assets including non. All Charitable Gift Annuity Special Permit Holders RE.

Charitable Gift Annuity CGA Reserve Attestation Language Requirements _____ The administration has noticed that. Enjoy charitable deductions and other tax-saving opportunities. Much or all of the annuity payment you receive will be tax free.

For the testamentary CGA. 133 rows Rates Announcement - 6222. In exchange for an irrevocable gift of cash securities or.

Another influential organization is the Partnership for Philanthropic Planning originally. A Charitable Gift Annuity is a contract between a donor and National Catholic Community Foundation that provides a lifetime of annuity payments to the donor and survivor or other. Admin - Wed 2122014 - 1036.

A charitable gift annuity CGA with NCF is a simple arrangement that involves a charitable gift and an annuity. As with any other.

Charitable Gift Annuity Metlife Retirement Income Solutions

Donors Find Gift Annuities Can Stop Giving Wsj

Gift Annuity Administration Software Crescendo Admin Crescendo Interactive

Act Now Charitable Gift Annuity Rates Have Increased Giving To Duke

8 Introduction To Charitable Gift Annuities Part 2 Of 3 Planned Giving Design Center

Charitable Gift Annuity Licensing Compliance In California Harbor Compliance

Deferred And Flexible Charitable Gift Annuities American College Of Trust And Estate Counsel Actec Foundation

Have You Participated In The Acga S Survey Of Charitable Gift Annuities Yet

Planned Gift Administration Pg Calc

Specimen Agreements Charitable Gift Annuity Planned Giving Resources Coursera

Charitable Gift Annuities Tiaa Cref

Charitable Gift Annuity National Gift Annuity Foundation

Gift Annuity Administration Services Crescendo Interactive

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

Cga Program Best Practices You Need To Know A Review Of The Acga Cgp Cga Survey

Charitable Gift Annuities Everence Faith Based Financial Services