us capital gains tax news

Less than one in 1000 Washingtonians are expected to owe the tax each year and only the wealthiest few. 12 Comments on Judge rules capital gains income tax is unconstitutional.

Irs Tax Brackets 2022 What Are The Capital Gains Tax Rate Thresholds Marca

The capital gains tax which was billed as legislation to tax only the most wealthy Washingtonians would impose a 7 tax on profits over 250000 from the sale of assets such as stocks bonds.

. But you have a tax-free allowance of 12300 in the 202122 tax. For single filers these rates range from 10 for taxable incomes up to 9950 to as high as 37 for taxable incomes of more than 523600. The first collections under the law would begin in 2023.

Although taxes may be due in 2022 a married couple filing jointly can recognize up to 83350 in capital gains and pay 0 in taxes if. NewsNow aims to be the worlds most accurate and comprehensive Capital Gains Tax news aggregator bringing you the latest headlines automatically and continuously 247. The Senate Bill 5096 took effect in January 2021 and levied a.

Earlier this week the president proposed a minimum 20 percent tax rate that would hit both the income and unrealized capital gains of US. WATERVILLE The state Attorney General is challenging a Douglas County Superior Court ruling that the 2021 capital gains tax violates the state Constitution. A judge has overturned a new capital gains tax on high profit stocks bonds and other assets that was approved by the Washington Legislature last year ruling that it is an unconstitutional tax on.

Meaning you selling it at a price higher than what you purchased it for this additional profit will be your capital gain. The capital gains tax on most net gains is no more than 15 percent for most people. Capital gains tax rates on most assets held for less than a year correspond to.

Households worth more than 100 million as part of his. Uncle Al March 4 2022 at 424 pm. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income.

OLYMPIA A judge has overturned a new capital gains tax on high profit stocks bonds and other assets that was approved by the state Legislature last year ruling that it is an unconstitutional tax on income. Judge Brian Hubers decision ruled the law violates the uniformity and limitation requirements of the state constitution. Bidens 58 trillion budget proposal includes a tax on unrealized gains meaning some Americans would have to pay for the appreciation of.

By Liz Weston April 3 2022 5 AM PT. Repeal the 16th Amendmentand the 17th while were at it. The IRS might penalize you if you havent paid enough tax even if you didnt know what your total capital gains or losses were until years end.

If you sell your house and make a profit on this sale. Relevance is automatically assessed so some. Attorney General Robert Ferguson has asked the state Supreme Court to review Judge Brian Hubers March 1 decision to invalidate the tax.

A state capital gains tax has been a hot topic for years ever since Democrats started talking about it as a way to raise money for key state services while helping fix what t. Jay Inslee signed into law in May of last year creates a 7 percent excise tax on capital gains above 250000 beginning this year. They call me tator salad March 4 2022 at 430 pm.

Senate Bill 5096 which Gov. As of 2021 the long-term capital gains tax is typically either zero 15 or 20 percent depending upon your tax bracket. More From Retirement Daily on The Street.

NewsNow brings you the latest news from the worlds most trusted sources on Capital Gains Tax. If I sell you my brand new car for a. Capital gains tax only becomes an issue on shares held outside an Isa and a pension which also grows free of capital gains tax.

Capital Gains Tax CGT is the tax paid on profits from selling assets such as property. Thursday March 3 2022 130am. Capital Gains Tax May Apply to Gifts Accruing Value The gift tax can apply to both cash and noncash gifts.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for more than a year. If your taxable income is less than 80000 some or all of your net gain may even be taxed at zero percent. Capital Gains Tax News.

The Capital Gains Tax Explained. Look this is Washington State just wait until this ends up in the corrupt state Supreme Court. WATERVILLE A new state law that levies a 7 tax on capital gains exceeding 250000 was ruled invalid Tuesday in Douglas County Superior Court.

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Selling Stock How Capital Gains Are Taxed The Motley Fool

House Democrats Propose Hiking Capital Gains Tax To 28 8

Capital Gains Definition 2021 Tax Rates And Examples

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

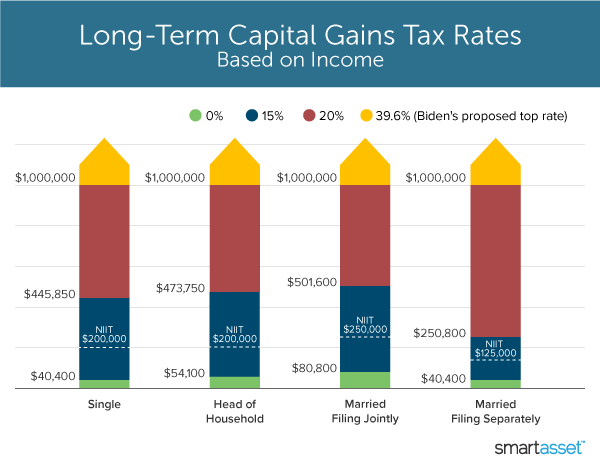

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gains Tax Advice News Features Tips Kiplinger

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Can Capital Gains Push Me Into A Higher Tax Bracket

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Long Term Capital Gain For Property Owner Critical Things To Know

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

Section 54 54f Income Tax Act Tax Exemption On Capital Gains

What S In Biden S Capital Gains Tax Plan Smartasset

Tax Flowchart Double Taxation Capital Gains Tax Capital Gain Risky Business